Binance plans to bring back tokenized stock trading after 2021 retreat

1/ Key takeaways

Binance is exploring the return of tokenized stock trading to bridge traditional finance with the crypto ecosystem. Despite past regulatory hurdles, the exchange aims to join competitors like OKX and Coinbase in offering blockchain-based shares.

2/ Binance plans to bring back tokenized stock trading after 2021 retreat

2.1. Binance Eyes a TradFi Comeback

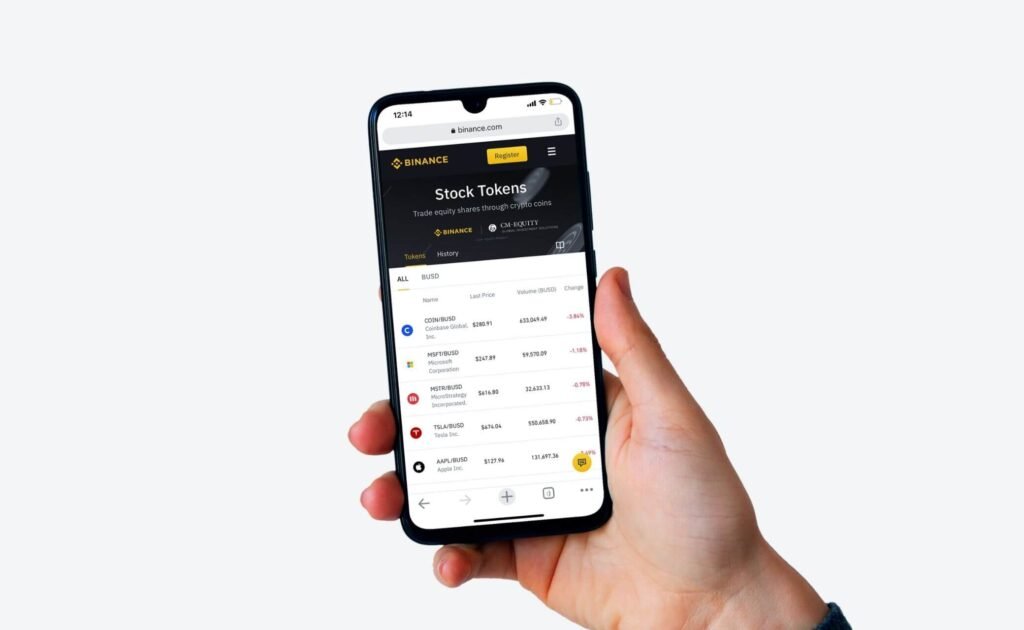

Binance is actively exploring the reintroduction of tokenized stock trading to its platform. This potential move comes five years after the exchange halted its initial 2021 offering due to regulatory pressure. These digital assets represent fractional shares of public giants like Apple or Microsoft. By leveraging blockchain technology, investors can buy tiny portions of high-value stocks. This mirrors real-time market prices without requiring a traditional brokerage account.

The exchange remains deeply committed to bridging the gap between decentralized finance (DeFi) and traditional markets. Recently, Binance expanded its ecosystem by supporting various real-world assets and regulated perpetual contracts. Reintroducing equities is a natural step in building a more inclusive financial infrastructure. This strategy focuses on providing users with diverse investment choices while upholding global compliance standards.

2.2. Navigating the 2026 Regulatory Landscape

The market for on-chain assets has evolved significantly since Binance’s first attempt in 2021. Today, major players like OKX and Coinbase are also developing their own on-chain stock products. Even traditional institutions like Nasdaq and the NYSE are seeking approval for tokenized offerings. This surge in interest reflects a growing demand for 24/7 trading and near-instant settlement. However, legal barriers still exist as the industry awaits the final passage of the Clarity Act in Congress.

Regulators like the SEC and the U.K.’s FCA continue to scrutinize how these tokens fit into existing securities laws. Unlike the “wild west” era of 2021, the current environment favors platforms that partner with traditional institutions. Industry leaders are currently pushing for legislative revisions to protect innovation while ensuring investor safety. As infrastructure improves, the successful integration of stocks on-chain will likely depend on clearer legal frameworks and robust KYC systems.

3/ Hola Tech’s pov:

To navigate the evolving landscape of tokenized equities, tech enthusiasts and organizations must prioritize regulatory alignment and technical interoperability as foundational pillars for adoption. Enthusiasts should focus on mastering on-chain identity solutions and self-custody tools, as the projected 2026 market growth will likely demand rigorous KYC verification for accessing fractionalized public shares. Meanwhile, organizations ought to invest in modular blockchain infrastructure that bridges decentralized finance with traditional settlement layers, ensuring they can pivot between synthetic and 1:1 backed asset models as legal frameworks like the Clarity Act stabilize. Furthermore, both parties must remain vigilant regarding platform-specific custodial risks, since the actual “bridging” of TradFi relies heavily on the transparency of third-party reserves.

Want to stay ahead of the curve in the world of decentralized technology and AI? Check out Hola Tech blog for more exciting technology news and useful information!