- Tracy

- blockchain, BNY, News, token

- 0 Comments

- 15228 Views

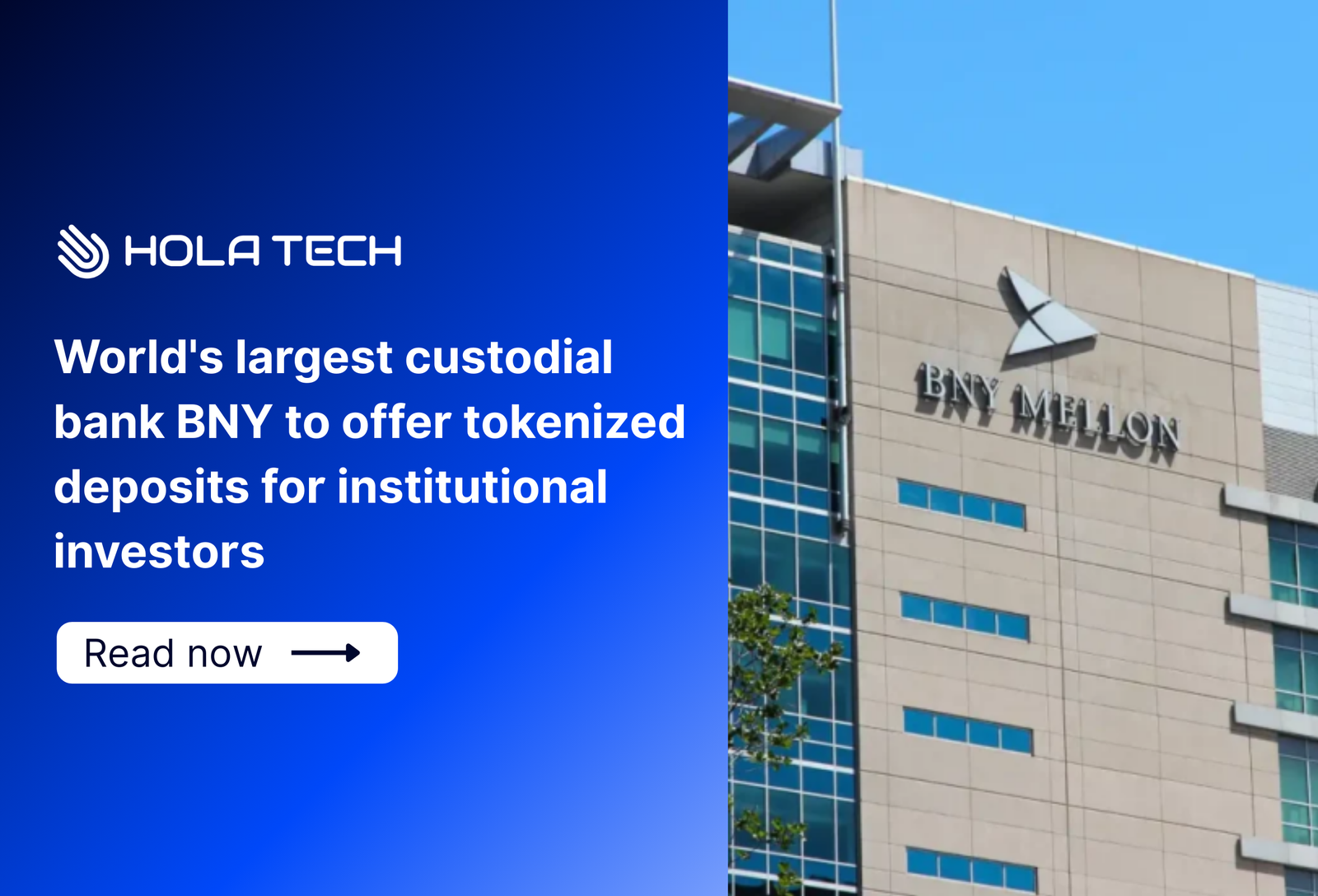

World’s largest custodial bank BNY to offer tokenized deposits for institutional investors

1/ Key takeaways

BNY, a global financial services company, has taken the first step in its strategy to tokenize deposits by enabling the on‑chain mirrored representation of client deposit balances on its Digital Assets platform. This launch helps to advance BNY’s ambitions to support programmable, on‑chain cash for institutional market infrastructure.

2/ World’s largest custodial bank BNY to offer tokenized deposits for institutional investors

2.1. What’s BNY?

The Bank of New York Mellon Corporation is an American financial giant. Most people call it BNY. It operates as an international services company with headquarters in New York City. The firm took its current form in July 2007. This followed the merger of the Bank of New York and Mellon Financial Corporation. BNY now functions as a massive global platform. Specifically, it oversees more than $58 trillion in assets for clients worldwide. This scale makes it a critical pillar of the modern financial industry.

2.2. BNY steps into tokenization

The industry just took a massive leap into the world of tokenization. On Friday, January 9, 2026, a major Wall Street player launched a new platform that allows institutional clients to settle bank deposits on a private blockchain. Currently, the system works by mirroring existing cash balances as “on-chain” entries. This supports faster settlement times and smarter liquidity management for high-volume users.

This official launch follows months of intensive testing aimed at modernizing global payment infrastructure. Specifically, the platform targets collateral and margin workflows where speed is essential for high-stakes trading. Carolyn Weinberg, Chief Product and Innovation Officer, noted that these “digital rails” allow clients to operate with much greater speed. Furthermore, early participants are already utilizing the system to move money without the delays of traditional banking hours.

The platform operates on a permissioned blockchain, ensuring that only authorized institutions can access the network. Moreover, the firm continues to record all actual balances on traditional ledgers to meet strict regulatory standards. This hybrid approach allows for 24/7 “always-on” functionality while maintaining the security of a global financial system. It bridges the gap between legacy banking and the emerging digital economy.

3/ Hola Tech’s pov:

The move toward tokenized deposits marks a critical turning point for ambitious fintech founders. This technology effectively eliminates the “banking hours” bottleneck, allowing your platform to manage liquidity and settle cross-border payments with unprecedented efficiency. Consequently, you can now design financial products that operate with the same speed as the internet itself. Furthermore, we advise startups to prioritize building for interoperability, as the biggest winners will bridge the gap between legacy ledgers and new digital rails. Integrating these programmable cash standards early helps reduce failed-trade risks and automates complex workflows like real-time revenue splits. Embracing this shift ensures your startup remains competitive in an increasingly “always-on” global economy.

Want to stay ahead of the curve in the world of decentralized technology and AI? Check out Hola Tech blog for more exciting technology news and useful information!