Deepcare’s PRM is a comprehensive system, process, and tools designed to effectively manage and optimize relationships with business partners. It aims to streamline communication, facilitate collaboration, and enhance the overall efficiency and profitability of indirect sales channels and strategic alliances.

AI

DefiVista

AI crypto tool

Confidential

2 months

AI

2025

AWS, Mongo Atlas, Infura IPFS, Lambda serverless, NodeJS, ReactJS

Introduction

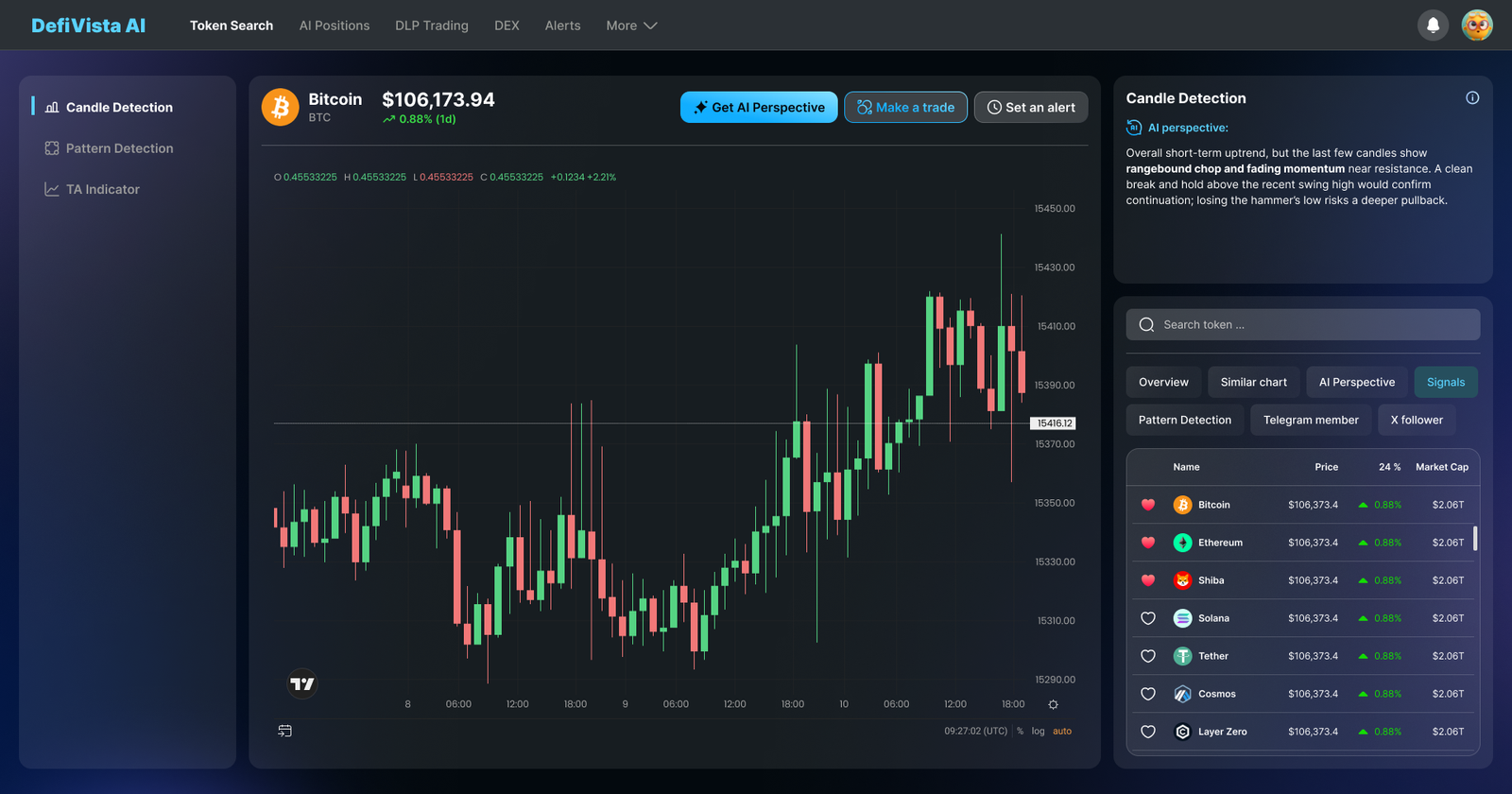

DefiVista is an Advanced Market Insights platform built to conquer the complexity and speed of the Decentralized Finance (DeFi) ecosystem. It moves beyond traditional data analysis by leveraging cutting-edge Generative AI.

Challenges

DefiVista aims to provide critical market intelligence for the Decentralized Finance (DeFi) space. However, several inherent market and technical challenges stand in the way of achieving high-quality, real-time insights:

– Data freshness and high volatility: DeFi markets are global and operate 24/7 with extreme volatility. The time lag between an on-chain event (like a major liquidation or a flash loan attack) and its reflection in the platform’s analysis is critical. Even a slight delay in data processing can render complex insights or automated signals useless, as the market conditions may have already shifted dramatically.

– Unpredictable data flow and volume: The volume of data ingestion is highly variable, spiking during major market events or protocol upgrades. The platform must handle sudden, massive bursts of transactional and pricing data from multiple chains simultaneously. Failing to ingest and process this unpredictable flow quickly leads to data backlogs, incomplete analysis, and an unreliable user experience.

– Black-box explainability of AI insights: The core value proposition relies on generative AI models to create human-readable summaries and predictive insights. However, the “black box” nature of complex AI can make it difficult to audit, explain, or fully trust the underlying rationale for a recommendation. This lack of transparency undermines user confidence, especially in a financially sensitive domain like DeFi.

Solutions

To overcome the challenges, Hola Tech adhered to the best practices. Key components of the solution included:

– Implement a streaming and caching architecture: To combat latency, the system should move from a periodic polling model to a real-time event-driven streaming model. This involves setting up specialized streaming queues to ingest on-chain data immediately and utilizing an in-memory caching layer to serve frequently requested, time-sensitive metrics directly to the user interface, ensuring near-instantaneous data delivery.

– Adopt an elastic and hybrid compute strategy: To handle unpredictable volume spikes, the platform needs a more elastic and cost-efficient compute strategy. This means reserving dedicated, persistent compute resources for continuous baseline tasks and using scalable, serverless functions only for transient, event-triggered workloads. This allows the system to absorb massive data spikes without immediately hitting failure limits or incurring excessive costs.

– Focus on Explainable AI (XAI) and data provenance: To build user trust, the AI layer must be augmented with XAI features. Solutions include designing models with built-in interpretability (e.g., using simpler models for critical decisions) and providing clear lineage for every data point. This allows users to drill down from a generated insight to the underlying smart contract data, validating the AI’s conclusion and promoting transparency.

Featured numbers

– Attracted over 8,500 active traders and analysts to the platform

– Reduced average critical data latency from 5 seconds to under 500 milliseconds

– Generated over 250,000 actionable insights and real-time risk alerts for users

Results

The implemented system successfully met DefiVista’s requirements for real-time performance, scalability, and insight quality. The platform has significantly enhanced the decision-making capabilities of DeFi participants, attracting over 8,500 active traders and analysts. DefiVista has empowered these users to navigate complex markets with greater confidence, with the AI layer already generating 250,000+ actionable insights and real-time risk alerts. This demonstrates DefiVista’s success in providing a transparent, low-latency, and intelligence-driven solution for the burgeoning decentralized finance ecosystem.

Other Projects

Kangamoon is an engaging two-player fighting game designed to offer an immersive combat experience. It allows players to customize their fighters by purchasing in-game items to enhance power and provides integrated deposit and withdrawal functionalities.

404War is a gaming product that aims to create immersive and adventurous digital realms for players to explore, master new skills, and discover hidden communities.

PreBuild is a software development company that aims to streamline the software planning and development process for businesses.