404War is a gaming product that aims to create immersive and adventurous digital realms for players to explore, master new skills, and discover hidden communities.

AI

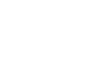

FinQuant AI

An AI-powered module for financial data analysis and investment strategy innovation

Confidential

10 months

AI

2024

AWS, Python, Pandas, NumPy, TensorFlow, Scikit-learn, PostgreSQL, Redis, FastAPI, ReactJS

Introduction

FinQuant AI is an advanced, specialized module designed to redefine financial data analysis and accelerate investment strategy innovation. Leveraging cutting-edge AI, it provides predictive modeling and pattern recognition capabilities that empower quants and portfolio managers to uncover hidden alpha and construct truly novel strategies.

Challenges

FinQuant AI aims to provide advanced, AI-powered insights for financial data analysis and investment strategy innovation. However, several challenges stand in the way of achieving this goal:

– Data quality, verification, and bias from mixed sources: Financial models require pristine, verified data. Errors or inconsistencies in on-chain data, or inherent biases present in historical trading data, can lead to severely flawed training for the AI models, resulting in suboptimal or misleading investment strategies and predictions.

– Latency in real-time on-chain data integration: For arbitrage detection or real-time risk assessment, the AI needs current state data. However, retrieving, processing, and normalizing decentralized financial data introduces a necessary delay.

– Explainability and regulatory compliance: The “black box” nature of sophisticated AI models makes it difficult to audit, explain, or fully trust the underlying rationale for a prediction. This lack of Explainable AI (XAI) is a major hurdle for regulatory approval and user confidence in the highly scrutinized financial sector.

Solutions

To overcome the challenges, Hola Tech adhered to the best practices. Key components of the solution included:

– Implement a multi-stage data validation pipeline: Use AWS Lambda functions to create stringent validation gates immediately after data ingestion. This involves cross-referencing on-chain data pulled from The Graph and Infura against traditional off-chain price feeds. Furthermore, apply fairness assessment techniques during the model training phase to mitigate known historical biases in the traditional financial data.

– Adopt a hybrid data polling strategy: Utilize the low-latency capabilities of a high-speed database (Mongo Atlas) for caching critical, frequently-requested data points (like asset prices and liquidity pool depths) with a very short Time-to-Live (TTL). Reserve The Graph for deep, historical, or complex relational queries, while ensuring NodeJS services actively push immediate, confirmed block data directly from Infura into the caching layer to feed time-sensitive AI models.

– Integrate modular and interpretable AI components: Do not rely solely on opaque deep learning models. Design the investment strategy pipeline to use modular components, where risk analysis is handled by more interpretable machine learning (IML) models (like decision trees or linear models). Use specialized XAI libraries in the NodeJS backend to generate audit trails, providing clear data provenance that traces every AI decision back to the specific validated inputs from both The Graph and traditional data sources.

Featured numbers

– Reduced the time required for analysts to perform scenario stress-testing for global events from 4 hours to under 5 minutes

– Generated over 10,000 custom, auditable explainability reports detailing the specific influence of external factors on projected stock movement

Results

The implemented system successfully met FinQuant AI’s requirements for predictive power, external environment integration, and actionable insights. FinQuant AI has empowered analysts to identify complex, non-obvious correlations between external global factors and specific stock performance with confidence. This demonstrates FinQuant AI’s success in providing a high-performance, verifiable, and intelligence-driven solution for incorporating comprehensive external environment analysis into financial modeling.

Other Projects

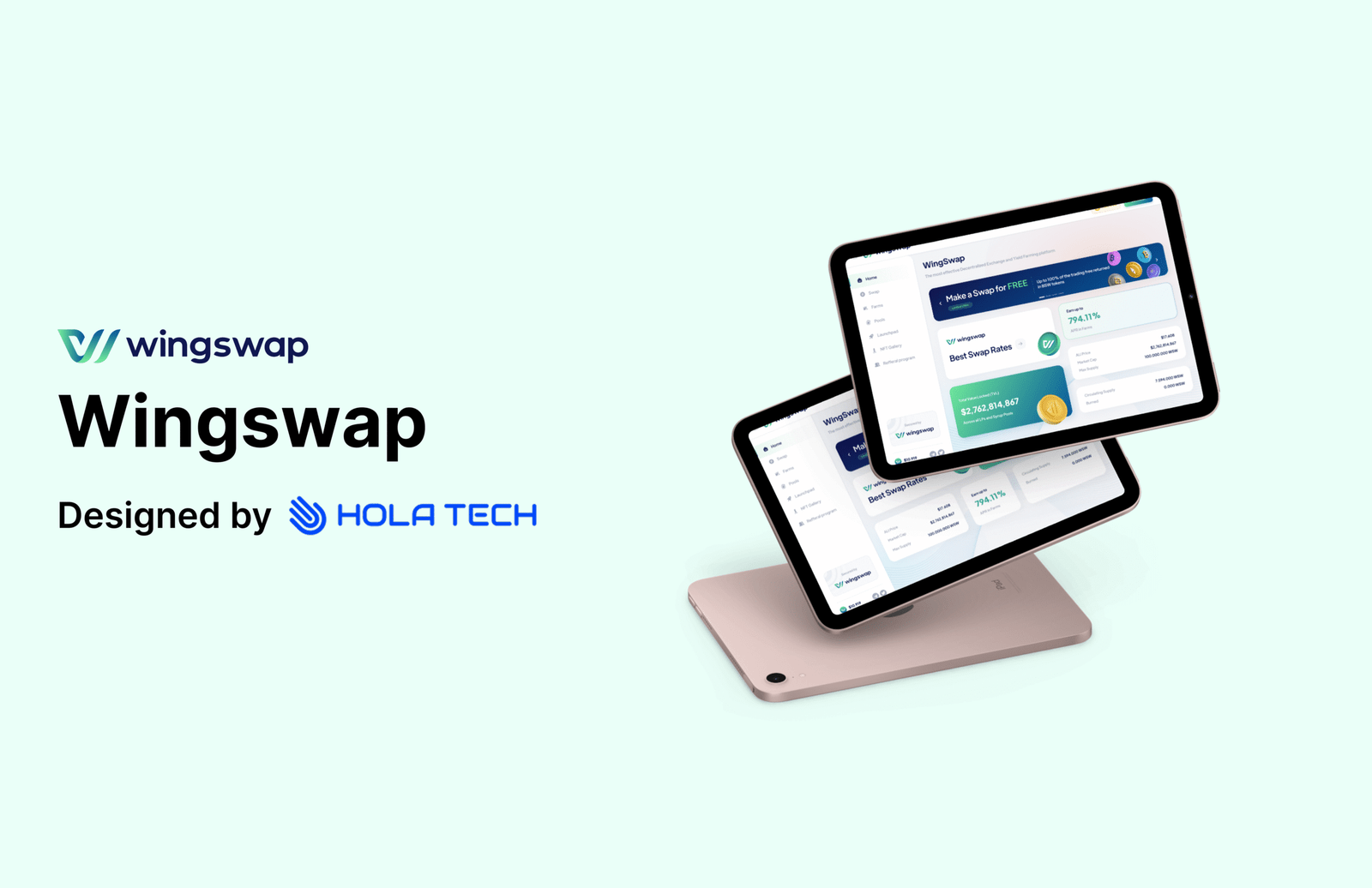

Wingswap is a decentralized finance (DeFi) platform that aims to provide automated, blazing-fast, and all-round solutions for the industry, enabling users to engage in yield farming, execute swaps and limit orders with low fees, and explore advanced NFT functionalities on a user-centric platform.

Monbase is an NFT marketplace platform that aims to facilitate the buying, selling, and discovery of NFTs across the BNB Chain, positioning itself as a leading digital asset exchange.

MadMAX is an interactive game on Telegram that aims to deliver an exhilarating endless runner experience, challenging players to collect unique in-game currency in a fast-paced and unpredictable environment.