- Tracy

- CEX, Crypto, DEX, Technology

- 0 Comments

- 13571 Views

DEX vs. CEX: Differences in cryptocurrency exchanges

1/ Key takeaways

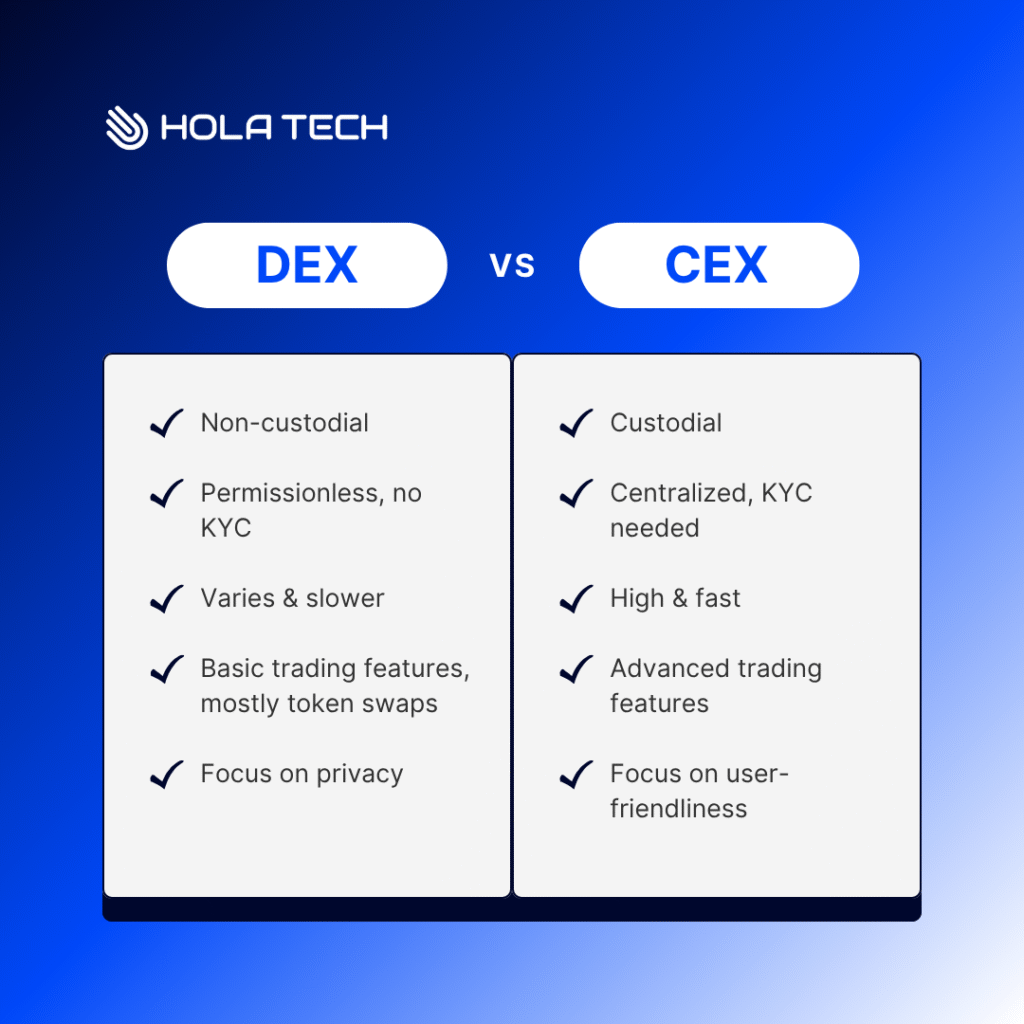

CEXs (Centralized Exchanges) prioritize ease of use, high liquidity, and fast transactions by relying on a third-party intermediary and custodial wallets, making them ideal for beginners and fiat-to-crypto transfers. In contrast, DEXs (Decentralized Exchanges) champion self-custody, privacy, and permissionless access by allowing peer-to-peer swaps via smart contracts and Automated Market Makers (AMMs), appealing to users who value control over their assets.

2/ DEX vs. CEX: Differences in cryptocurrency exchanges

2.1. What’s DEX

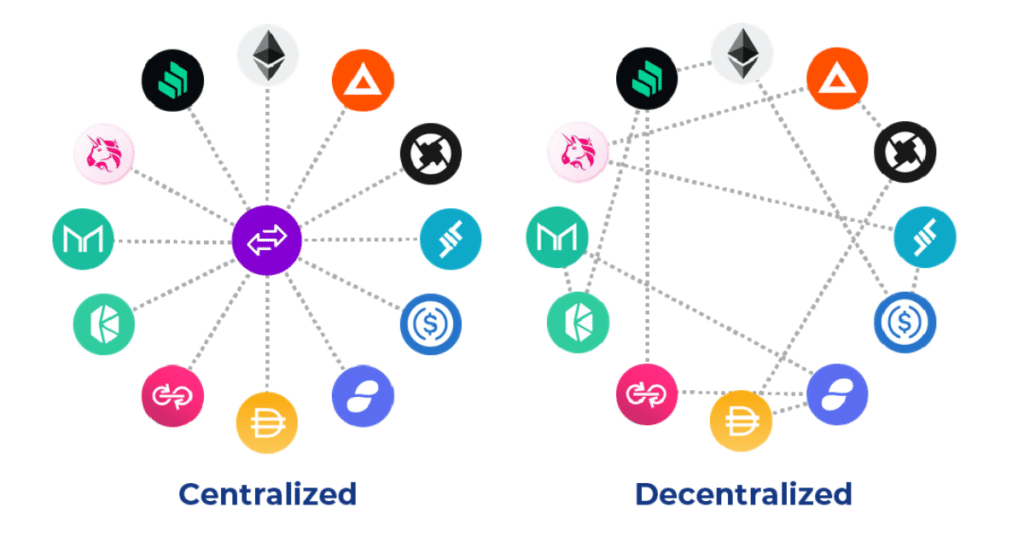

A Decentralized Exchange (DEX) is a non-custodial crypto exchange where users can swap tokens directly on the blockchain without any centralized intermediary. This peer-to-peer approach embodies the core tenets of Web3: self-custody and permissionless access. To trade, you simply connect your non-custodial crypto wallet (e.g., MetaMask, Ledger)—no user accounts or Know Your Customer (KYC) identity verification are required. This radical privacy and control make DEXs a popular choice for crypto natives.

Unlike traditional exchanges that use an order book, most modern DEXs operate using Automated Market Makers (AMMs). This innovative system replaces traditional buyers and sellers with liquidity pools funded by other users, known as Liquidity Providers (LPs). LPs deposit a pair of tokens (e.g., ETH/USDC) into a smart contract pool, and traders swap tokens directly from this pool. A mathematical formula (often x∗y=k) automatically determines the token price, ensuring efficient, constant liquidity.

Some popular decentralized exchanges include:

- Uniswap: The leading Ethereum-based DEX by trading volume and total value locked (TVL). Uniswap is the pioneer of the AMM model, offering deep liquidity for thousands of ERC-20 tokens.

- PancakeSwap: Built on Binance Smart Chain (BSC), PancakeSwap popular for lower fees and access to a wide variety of tokens.

- Curve Finance: Specializes in stablecoin swaps, offering low slippage and efficient trading for pegged assets.

2.2. Pros and cons of DEX

DEX Pros | DEX Cons |

Complete self-custody: Your private keys remain in your wallet, meaning the DEX cannot freeze your assets or halt your transactions. | Limited trading options: Primarily focused on basic token swaps; lacks advanced features like margin, futures, or complex order types common on CEXs. |

No account restrictions/KYC: Permissionless access allows anyone globally to begin trading in seconds without revealing personal information. | Slower transaction speed & high gas fees: Transactions must be validated on-chain by miners, making them generally slower and subject to network congestion/fees (e.g., Ethereum gas). |

Reduced centralized security risk: A platform hack does not expose user funds, as assets aren’t held in a centralized hot wallet. | Lower liquidity & volume: CEXs still dominate the majority of crypto spot trading volume, leading to potentially lower liquidity and higher slippage on some DEX pairs. |

Access to new & rare tokens: New projects can easily list their tokens and create pools, offering early access to high-potential assets before CEX listing. | Less user-friendly interface: Often requires more technical understanding of wallets, gas fees, and smart contract interaction, creating a steeper learning curve for beginners. |

2.3. What’s CEX

Centralized Exchanges (CEXs), like traditional electronic stock exchanges, facilitate crypto trading through a trusted, centralized intermediary. When you create an account, you deposit funds into the exchange’s custodial wallet, entrusting them with the security of your private keys. Trades are matched off-chain using a high-speed order book system and an internal matching engine.

This model allows CEXs to process a massive volume of transactions per second, offering users a familiar, intuitive, and feature-rich trading experience. However, it requires users to trust the exchange to manage security, maintain solvency, and comply with strict regulations.

This system allows CEXs to process thousands (or even millions) of transactions per second, offering users fast execution and a familiar interface. However, it also means users must trust the exchange to safeguard their assets and private keys, comply with regulations, and remain solvent.

Notable CEXs include:

- Binance: The world’s largest exchange, offering deep liquidity across hundreds of tokens and a wide array of advanced trading tools.

- Coinbase: A U.S.-based, publicly listed exchange known for its compliance and user-friendly platform that appeals to beginners.

- Kraken: Highly regarded for its robust security and support for a large range of global fiat currencies.

2.4. Pros and cons of CEX

CEX Pros | CEX Cons |

High liquidity & trading volume: Attracts the vast majority of traders, leading to tight spreads, minimal slippage, and efficient large-volume trades. | Lack of privacy: Users must complete mandatory identity verification, which involves sharing private information and potentially limits global access. |

Simple fiat-to-crypto on/off-ramps: Seamlessly convert fiat currency (USD, EUR, etc.) into crypto and back, acting as an essential gateway for new users. | Lack of control: The platform holds your private keys and can freeze your funds, suspend trading, or restrict access at their discretion. |

Blazing fast transactions: Off-chain matching systems process thousands, sometimes millions, of orders per second, ensuring instantaneous trade execution. | Single point of failure: The centralized nature of the exchange’s custodial wallets makes it a prime target for hackers; a successful breach can result in the loss of user funds. |

More user-friendly & trading features: Intuitive interfaces resembling traditional finance platforms are easier for beginners. Offers advanced trading options like futures, margin, lending, and staking. | Potential loss due to insolvency: Users are exposed to the risk of the exchange becoming insolvent or mismanaging funds, as seen in past industry failures. |

3/ Hola Tech’s pov:

Centralized Exchanges (CEXs) and Decentralized Exchanges (DEXs) serve distinct purposes in the crypto ecosystem. You should opt for a CEX when your priority is convenience, high liquidity, and access to advanced trading features like margin or futures. CEXs are user-friendly, offer fiat currency gateways, and provide robust customer support, making them ideal for new users or those prioritizing a traditional trading experience. Conversely, a DEX is the right choice when you value privacy, complete self-custody of your assets, and permissionless access. Since they operate without intermediaries via smart contracts, DEXs are the embodiment of blockchain’s decentralized ethos, best suited for experienced users and those wary of third-party risk or KYC requirements. Neither platform is inherently superior; the best choice depends on whether your project’s target audience values ease of use and fiat access (CEX) or control and decentralization (DEX).

Building a secure, scalable, and compliant exchange, whether centralized or decentralized, is a complex technical undertaking that requires specialized expertise. If your goal is to launch a CEX or DEX project, it is critical to carefully choose a development partner with a proven track record in this niche industry. A capable partner, such as Hola Tech, will bring invaluable experience in blockchain security, smart contract auditing, regulatory compliance (for CEXs), and liquidity integration. This technical proficiency ensures your platform is not only competitive and feature-rich but also resilient against exploits and future-proofed against evolving industry standards. Choosing a seasoned partner is the most effective way to navigate the challenges of exchange development and ensure a successful market launch.

Want to stay ahead of the curve in the world of decentralized technology and AI? Check out Hola Tech blog for more exciting technology news and useful information!